Latency arbitrage is one of the most profitable — and most controversial — trading strategies in the forex industry. It exploits the tiny time gaps between when a price changes on one source and when a broker updates its own quotes. In those precious milliseconds lies a window of opportunity that generates consistent profits for those who understand and can execute it. This guide is the most comprehensive public resource on latency arbitrage and HFT strategies in retail forex.

What Is Latency Arbitrage?

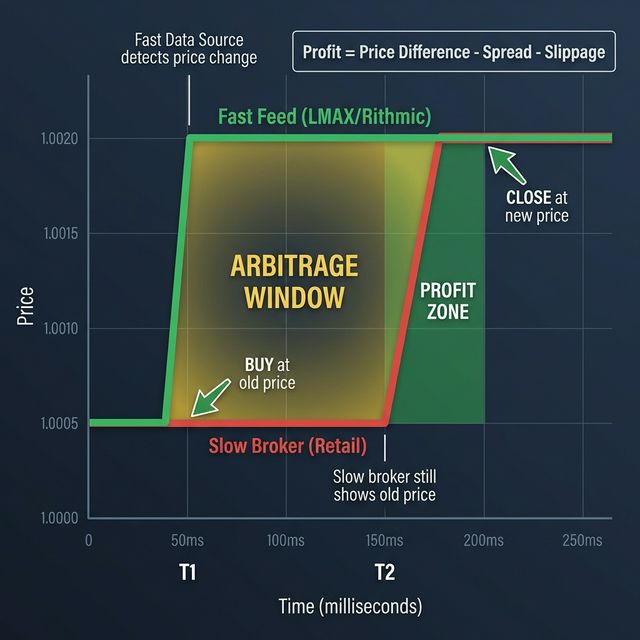

At its core, latency arbitrage exploits speed differences between data sources. Financial market prices update constantly, but not all price feeds update at the same speed. A "fast" feed (such as a direct exchange feed or a top-tier ECN) receives new prices milliseconds before "slower" feeds that most retail brokers use.

When the fast feed shows a price change, but the slow broker hasn't updated yet, the trader can execute a trade at the broker's "stale" price, knowing (with high probability) that the broker's price will adjust shortly. It's like knowing the winning lottery numbers a few seconds before they're announced.

The Anatomy of a Latency Arbitrage Trade

Here's exactly how a single latency arbitrage trade works, step by step:

- Step 1: The algorithm continuously monitors a fast data feed (e.g., LMAX Exchange, Rithmic, CME) and the broker's price feed simultaneously

- Step 2: A significant price movement occurs on EUR/USD — the fast feed jumps from 1.08500 to 1.08520 (a 2-pip move)

- Step 3: The broker's price is still at 1.08500 — it hasn't updated yet (5-50ms delay)

- Step 4: The algorithm instantly sends a BUY order to the broker at 1.08500

- Step 5: Within 10-100ms, the broker's price catches up and moves to 1.08518-1.08522

- Step 6: The algorithm closes the trade at the new, higher price, capturing most of the 2-pip move

- Step 7: Rinse and repeat — hundreds of times per day across multiple instruments

A typical latency arbitrage setup might capture 0.5-3 pips per trade, with a win rate of 75-95%. On a standard lot (100,000 units), 1 pip = ~$10. Even at 0.5 pips average with 100 trades/day, that's $500/day or $10,000/month. The math is straightforward — but so are the challenges.

Where Does the "Fast" Data Come From?

The quality of your fast data feed is the single most important factor in latency arbitrage. The faster and more reliable your feed, the more opportunities you can capture. Here are the primary sources of fast data:

1. Exchange Direct Feeds

The fastest data comes directly from exchanges. These are institutional-grade feeds that deliver raw market data with minimal processing:

- CME (Chicago Mercantile Exchange) — Gold standard for forex futures and metals. The CME Market Data feed provides tick-by-tick data with sub-millisecond updates. Available through direct connections or data vendors like Rithmic.

- LMAX Exchange — A London-based MTF (Multilateral Trading Facility) that provides institutional-grade forex pricing. LMAX is one of the most popular fast feeds for forex latency arbitrage.

- Cboe FX (formerly Hotspot) — Another major institutional forex venue providing direct market data.

- ICE (Intercontinental Exchange) — Provides fast data for commodities, indices, and currency futures.

2. ECN/Prime Broker Feeds

Some ECN brokers and prime-of-prime providers offer feeds fast enough to use as reference prices:

- Rithmic — Popular API for accessing CME data. Provides very fast tick data with low latency when co-located near their servers (Chicago).

- CQG — Another CME data provider with institutional-grade APIs.

- Currenex — Electronic FX trading platform used by banks and institutions.

- Integral — Aggregates liquidity from multiple banks, providing fast composite feeds.

3. Fast Retail Brokers as Feeds

Some arbitrage traders use another fast retail broker as a reference feed instead of paying for exchange data. Brokers with very fast price updates — such as LMAX, IC Markets, or Pepperstone (via co-located VPS) — can serve as a "fast" feed compared to slower brokers. This approach is cheaper but less reliable than direct exchange feeds.

The speed advantage doesn't need to be large. Even a 5-20 millisecond difference between your fast feed and your broker's price update is enough to capture consistent profits. BrokersDB's server location data helps you identify which brokers are faster and which are slower based on their infrastructure.

Types of HFT & Arbitrage Strategies

1. One-Leg Latency Arbitrage

The simplest form. You compare a fast feed to one slow broker and trade the broker when its price is stale. The trade is opened and closed at the same broker. Profit comes from the broker's price catching up to the real market price.

2. Two-Leg (Hedge) Arbitrage

Instead of closing the trade at the same broker, you simultaneously open an opposite position at a second broker (or the same instrument via a different account). This creates a locked/hedged position where you're guaranteed a profit equal to the price difference between the two entries. This strategy has lower risk but requires accounts at multiple brokers and careful position management.

3. Multi-Leg Spread Arbitrage

More sophisticated strategies trade correlated instruments across multiple brokers simultaneously. For example, if EUR/USD moves up on the fast feed, you might simultaneously buy EUR/USD at one slow broker and sell GBP/USD at another, exploiting the correlation between the pairs and the latency differences between the two brokers.

4. News-Based HFT (News Spike Trading)

Economic news releases (NFP, CPI, interest rate decisions) cause immediate, sharp price movements. HFT algorithms parse the news data (often from ultra-fast feeds like Reuters Elektron or Bloomberg B-PIPE) and execute trades milliseconds before the broader market reacts. This requires both speed and natural language processing (NLP) capabilities.

5. Statistical Arbitrage / Mean Reversion HFT

These strategies use statistical models to identify when prices temporarily deviate from their equilibrium values and trade the expected reversion. While not strictly "latency" arbitrage, they benefit significantly from fast execution and low latency because the opportunities are fleeting.

Why Brokers Hate Latency Arbitrage

Latency arbitrage is deeply controversial because of how it interacts with broker business models. Understanding this conflict is crucial:

The Market Maker Problem

Most retail forex brokers operate as market makers (or B-book brokers). When you buy EUR/USD, the broker takes the other side of your trade — they sell EUR/USD to you. If you're a normal retail trader who loses money, the broker profits. But latency arbitrage traders win consistently, which means the market maker consistently loses.

From the broker's perspective, latency arbitrage is equivalent to someone counting cards at a casino — technically they're just trading, but their systematic edge makes the dealer (broker) unprofitable. This is why brokers actively fight against it.

The ECN/STP Broker Problem

Even ECN/STP brokers that route orders to liquidity providers (LPs) have issues with latency arbitrage. When a latency arbitrage trader exploits a stale price, the LP fills the order at a losing price. The LP then complains to the broker, marks the flow as "toxic," and may widen spreads, reduce fill rates, or cut off the broker's access. Brokers risk losing their LP relationships if they can't manage toxic flow.

How Brokers Detect and Fight It

- Execution Delays ("Virtual Dealer" Plugins) — Brokers add artificial delays (50-500ms) to order execution. This gives prices time to update, eliminating the latency advantage.

- Slippage — Brokers may fill orders at the updated (worse) price instead of the requested price, claiming market movement during execution.

- Trade Duration Analysis — If your average trade duration is under 1-2 minutes, it's flagged as potential arbitrage. Normal retail traders hold positions much longer.

- Profit Pattern Analysis — A consistent win rate above 70-80% on short-duration trades triggers automated alerts.

- IP and Account Monitoring — Brokers track your IP address, VPS location, connection latency, and trading patterns to identify arbitrage setups.

- Account Restrictions — Brokers may switch your account from "instant execution" to "market execution," increase spreads, or ultimately close your account.

- FIX API Restrictions — Some brokers limit or remove FIX API access for accounts flagged as latency arbitrage.

Most broker terms of service include clauses that prohibit "abusive trading practices," which they interpret to include latency arbitrage. While there's no law against it, brokers can and do close accounts and withhold profits if they determine you're engaging in latency arbitrage.

Masking Techniques: The Art of Staying Undetected

Sophisticated latency arbitrage traders use various techniques to disguise their activity and extend account longevity. This is the "art" side of what is otherwise a purely technical strategy:

1. Hedge Masking (Two-Leg Strategy)

Instead of opening and closing trades quickly at one broker (which is an obvious arbitrage pattern), the trader opens a position at the slow broker and simultaneously opens the opposite position at another broker or liquidity provider. The arbitrage profit is locked in at the moment both legs are filled. Neither broker sees rapid open-close patterns — the position at each broker might remain open for hours or even days before being selectively closed.

Advanced hedge masking involves "breathing" — randomly delaying the close of one leg to create natural-looking trade durations. Some systems also add randomized lot sizes and occasional intentional losing trades to make the pattern look like normal trading.

2. Multiple Accounts Identity Rotation

Traders spread their activity across many accounts and even multiple brokers of the same parent company. Each individual account generates modest profits that don't trigger alerts. Some operations use different identities (family members, business entities) to maintain a large pool of accounts.

3. Proxy and IP Rotation

Brokers track the IP addresses that connect to their trading servers. If they see multiple accounts connecting from the same data center IP (especially one in a known financial hub like Equinix LD4), it raises red flags. To counter this:

- Residential proxies — Route trading connections through residential IP addresses in different countries, making it look like individual traders at home

- VPN rotation — Use different VPN exit points for different accounts

- Multiple VPS providers — Spread accounts across different VPS providers and locations instead of using a single co-located server

- Dedicated IPs — Each account gets its own unique IP address that doesn't share ranges with other trading accounts

4. Execution Randomization

Instead of executing trades immediately when a signal appears (which creates a perfectly predictable pattern), sophisticated algorithms introduce random delays. For example:

- Random entry delay — 0-200ms random delay before executing, simulating human reaction time

- Minimum trade duration — Hold positions for a random minimum time (e.g., 30 seconds to 5 minutes) instead of closing immediately

- Skip signals randomly — Intentionally skip some profitable signals to reduce win rate from 95% to a less suspicious 65-70%

- Vary lot sizes — Use random position sizes within a range instead of fixed lot sizes

- Add "noise" trades — Place occasional trades that aren't arbitrage-driven to create a more normal-looking trading pattern

5. FIX API: The Professional Edge

FIX (Financial Information eXchange) protocol is the institutional standard for electronic trading. Some brokers offer FIX API access for high-volume clients. This is significant for latency arbitrage because:

- Faster execution — FIX API bypasses the MetaTrader server entirely, communicating directly with the broker's matching engine. This can reduce execution time by 20-50ms compared to MT4/MT5.

- Direct market access — FIX connections provide more transparent access to the broker's liquidity pool.

- Less monitoring — Some brokers apply less aggressive latency arbitrage detection on FIX accounts compared to MT4/MT5 accounts.

- Professional appearance — FIX API accounts are typically classified as institutional/professional, which may receive less scrutiny.

- Custom order types — FIX protocol supports advanced order types not available through MetaTrader.

FIX API access typically requires a larger minimum deposit ($5,000-$50,000+) and is usually offered only to professional or institutional clients. Brokers like LMAX, cTrader-based brokers, and some ECN brokers offer FIX API connections.

The Infrastructure Stack: What You Need

Setting up a professional latency arbitrage operation requires specific infrastructure components:

| Component | Purpose | Typical Cost |

|---|---|---|

| Fast Data Feed | Provides the reference price (LMAX, Rithmic, CME) | $100-$500/month |

| VPS / Co-location | Server near broker's data center for minimal latency | $30-$200/month |

| Arbitrage Software | Algorithm that compares feeds and executes trades | $100-$2,000/month |

| Broker Accounts | Multiple accounts at different brokers | Deposits vary |

| Proxy/VPN Services | IP masking for account protection | $50-$200/month |

| Monitoring Tools | Track execution quality, latency, and P&L | $0-$100/month |

Server Location is Everything

The single most critical infrastructure decision is where to locate your trading server. Ideally, your VPS should be in the same data center as your broker's trading server. This is where BrokersDB's server location data becomes invaluable — we show you exactly where each broker hosts their trading servers, allowing you to choose a VPS location that minimizes latency.

Common VPS locations for latency arbitrage:

- London (Equinix LD4/LD5, Slough) — The #1 location. Most forex brokers have servers here. LD4 is the epicenter of forex infrastructure.

- New York (Equinix NY4/NY5) — Critical for US stocks, options, and brokers with US operations.

- Tokyo (Equinix TY3) — Key for Asian session trading and Japanese brokers.

- Amsterdam (Equinix AM5) — Major European hub, especially for Dutch and pan-European brokers.

- Singapore (Equinix SG1) — Hub for Southeast Asian brokers.

- Frankfurt (Equinix FR2) — Important for German-regulated brokers and European ECNs.

- Chicago (various) — Essential when using Rithmic/CME as a fast feed, since CME's matching engine is in Aurora, IL.

Popular Arbitrage Software

Several commercial software packages are available for latency arbitrage. Each has different features and price points:

| Software | Key Features | Price Range |

|---|---|---|

| Westernpips | One of the oldest. Supports MT4/MT5, FIX API. Built-in feed connections. | $1,000-$20,000 (lifetime) |

| BJF Trading Group | Offers various arbitrage EAs for MT4/MT5, hedge mode, masking tools. | $500-$5,000 |

| SharpTrader | Modern interface, multi-broker support, built-in masking. | $500-$3,000/month |

| LockCL / LatencyArb | Focuses on lock arbitrage (two-leg hedge), multiple broker support. | $300-$1,500/month |

| Custom Solutions | Built in-house using Python, C++, or C#. Most flexible but requires development resources. | Development cost |

The Reality Check: Challenges and Risks

While latency arbitrage can be highly profitable, it's far from easy money. Here are the real challenges:

- Account Longevity — The #1 problem. Profitable latency arbitrage accounts are typically detected and restricted within 1-4 weeks at most brokers. You need a constant pipeline of new accounts.

- Profit Withdrawal — Brokers may refuse to pay out profits earned through arbitrage. You must withdraw regularly and in small amounts to minimize risk.

- Slippage — As brokers improve their detection, they add execution delays that eat into your edge. A strategy that captures 1 pip becomes unprofitable with 1.5 pips of slippage.

- Cost of Infrastructure — VPS fees, data feed subscriptions, software licenses, and proxy services add up. You need consistent volume to cover monthly costs.

- Diminishing Opportunities — As broker technology improves, the latency gaps narrow. What worked 5 years ago may not work today without more sophisticated approaches.

- Legal Gray Area — While not illegal, latency arbitrage violates most brokers' terms of service. Profits can be voided, and accounts can be closed retroactively.

- Emotional Drain — The constant cycle of opening accounts, getting flagged, dealing with withdrawal issues, and finding new brokers is exhausting.

This article is for educational purposes. Latency arbitrage involves significant risks including potential loss of deposited funds if a broker refuses to pay profits. Always review a broker's terms of service, understand the risks, and consider consulting legal advice before engaging in arbitrage trading.

The Future of Latency Arbitrage

The cat-and-mouse game between arbitrage traders and brokers continues to evolve:

- AI-Powered Detection — Brokers are deploying machine learning models that can identify arbitrage patterns even when heavily masked. These models analyze trade timing, win rates, trade duration distributions, and correlation with market microstructure events.

- Faster Broker Technology — As brokers upgrade their infrastructure (better data centers, faster feeds, smarter liquidity aggregation), the latency gaps shrink. Strategies that worked with 50ms advantage now need sub-5ms.

- Regulatory Attention — Some regulators are beginning to look at the practices of both brokers (adding excessive delays) and traders (latency arbitrage), potentially creating clearer rules.

- Shift to Crypto — Cryptocurrency markets, with their fragmented exchanges and 24/7 trading, present new arbitrage opportunities with wider latency gaps than traditional forex.

- Hardware Acceleration — FPGA (Field-Programmable Gate Array) and custom hardware solutions are pushing execution speeds to nanosecond levels in the institutional space.

Key Takeaways

- Latency arbitrage exploits the speed difference between fast data feeds and slower broker price updates

- The profit comes from trading at "stale" prices before the broker updates — typically capturing 0.5-3 pips per trade

- Fast data sources include CME (via Rithmic), LMAX Exchange, and fast ECN brokers

- Brokers detect and fight arbitrage using execution delays, slippage, trade pattern analysis, and account restrictions

- Masking techniques include hedge arbitrage, IP rotation, execution randomization, and FIX API

- Server location and infrastructure are critical — BrokersDB helps you find where each broker's servers are located

- Account longevity is the biggest operational challenge — most accounts are detected within weeks

- The strategy remains viable but requires increasingly sophisticated approaches as broker technology improves

Whether you're an algo trader optimizing execution or researching broker infrastructure, BrokersDB provides unique server location data for 2,949+ brokers across 69 countries. Understanding where your broker's servers are located is the first step to optimizing your trading performance.

Find Your Perfect Broker

Compare 539+ verified brokers with real server infrastructure data.